- Kalshi Kit

- Posts

- Election Contracts are Almost Here

Election Contracts are Almost Here

pending regulatory approval.

Election markets are squarely legal, in the public interest and adamantly wanted by said public. Friday, the CFTC will decide not just our fate but also the state of American innovation moving forward. Let's dive in to the moves shaping our markets, future markets and trading strategies.

Bottom Line Up Front

ICYMI: We're giving away $100K to find America’s best forecaster.

Oil rose on speculation that Beijing was considering cutting the quarantine period for visitors from ten days to seven. China, the world’s largest crude importer, has stuck to strict COVID-19 curbs this year, reducing demand for fuel.

The US housing market’s sudden reversal is sapping demand and pushing prices down the most since 2009. A measure of prices in 20 large US cities in August fell 1.3% on a month-over-month basis.

Deep Dive: How to Trade WTI Oil

The use of oil, specifically in fuels, continues to propel it as a high-demand commodity around the globe. To extend this popularity, investors began oil trading. “Oil trading,” in this sense, is the buying and selling of different types of oil and oil-linked assets with the aim of making a profit. Oil is a finite resource, so its price fluctuates substantially with supply and demand changes. This volatility makes it extremely popular among traders.

There are three ways you can trade oil: spot prices, futures and options. Let's deep dive into spot prices.

What is oil spot price?

Oil spot prices represent the cost of buying or selling oil immediately. Think “on the spot,” instead of a set date in the future. While futures prices reflect how much the markets believe oil will be worth when the future expires, spot prices show how much it is worth right now. WTI oil is priced daily, so its spot price reflects its real-time value in the market.

How is the spot price determined?

Oil has a longstanding role as a high-demand global commodity. This popularity comes from the possibility that major fluctuations in price can have a significant economic impact. The two primary factors that impact the price of oil are:

Supply and demand

Cost of production

Supply & Demand

The concept of supply and demand is directly correlated to most commodities’ prices. That is because as demand increases, or supply decreases, the price is expected to go up. As demand decreases, or supply increases, the price should go down.

WTI Oil

West Texas Intermediate (WTI) crude oil is a specific grade of crude oil and one of the main three benchmarks in oil pricing, along with Brent and Dubai Crude. WTI is the underlying commodity of the New York Mercantile Exchange's (NYMEX) oil futures contract and is considered a high-quality oil that is easily refined. WTI is the main oil benchmark for North America as it is sourced from the United States, primarily from Texas.

The use of benchmarks in the oil market is crucial, because the benchmark sets the context. In the oil market, benchmarks serve as a reference price for buyers and sellers of crude oil. When watching or reading the news, the price of oil is typically quoted from an oil benchmark.

Benchmarks are not unique to the oil market though, and also cited across markets. For example, indices serve as another example in the equities market. If you want to see how your portfolio is performing in the current market, you can use the S&P 500’s return over the same time period as the benchmark to assess your performance.

How to Trade WTI Oil

Like any market, oil trading requires research and investment sizing. Basic supply and demand theory states that the more a product is produced, the more cheaply it should sell. It's an inverse relationship. For example, if an engineer invented a technique that could double an oil field's output for only a small incremental cost, such as fracking, then the prices should fall.

This is where oil trading gets interesting. Because oil is such a hot commodity, distribution and refinement may not always be caught up with production. As a result, there is a substantial demand and need for more oil, but fundamentally not enough supply because distribution networks cannot substantiate the demand. For example, the reason America does not have an overwhelming supply of cheap oil is because refineries are organized specifically for this problem. Reports cite that refineries operate at 90% of capacity in order to try and always supply the 10% when need be.

Geopolitical Forces Impacting Oil Prices

Beyond distribution networks for oil, there is also the problem of producer cartels. Probably the single biggest influencer of oil prices is OPEC+. This organization is made up of 13 countries: Algeria, Angola, Congo, Equatorial Guinea, Gabon, Iran, Iraq, Kuwait, Libya, Nigeria, Saudi Arabia, United Arab Emirates, and Venezuela). Collectively, OPEC controls 40% of the world's supply of oil (in 2022).

OPEC+ was originally founded in order to fix oil and gas prices. By restricting production, OPEC+ could force prices to rise. This forceful strategy would thus allow member countries to profit and each sell on the world market at the going rate. Throughout the 1970s and much of the 1980s, it followed this sound, if somewhat unethical, strategy.

Takeaways

“West Texas Intermediate” (WTI) oil is the main oil benchmark for North America.

Supply and demand, and expectations thereof, are the main drivers of oil’s price.

The costs of oil extraction and production are also important considerations for its price.

Oil traders are segmented in two main camps: speculators who trade on price moves, and hedgers who limit their risk.

Both geopolitical and macroeconomic factors are important areas of research to find an edge in oil trading.

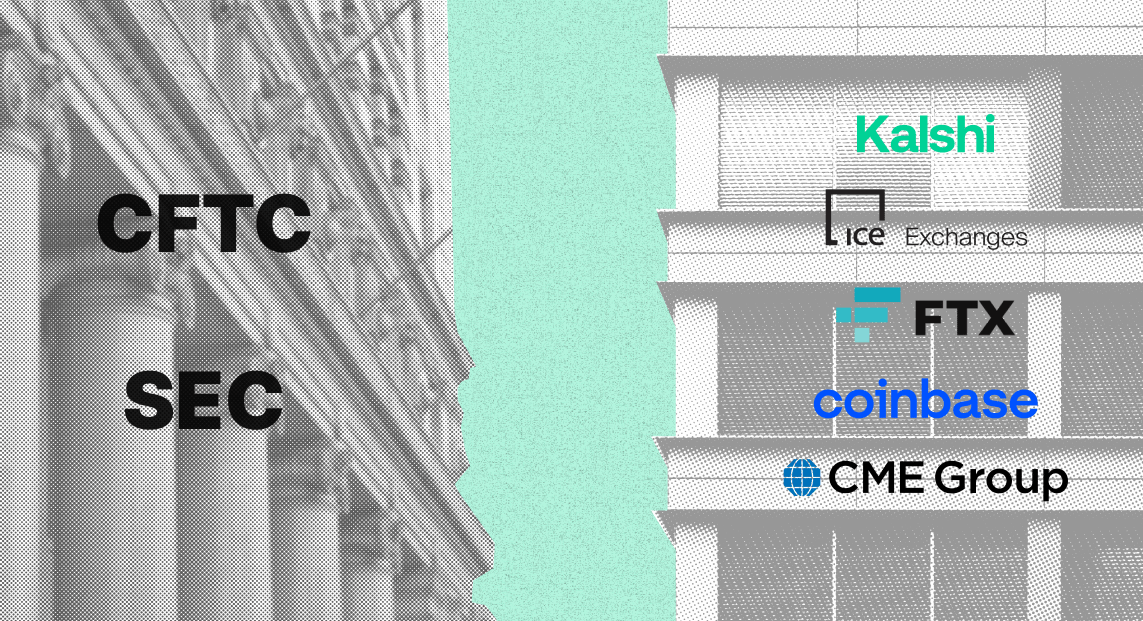

The Restriction of Responsible Innovation

Every crisis has its response. In the early 1930s, the Banking Act sought to right wrongs of the Great Depression and protect both households and the banking system. Seventy years later, the Global Financial Crisis prompted the Dodd-Frank Act. Now, the unprecedented growth of cryptocurrency has raised flags to regulate the sector under either the SEC or CFTC. Now, more than ever, the American public relies on these organizations to incorporate changes in the market in their decisions to promote the public welfare.

Regulatory clarity that promotes responsible innovation is what distinguishes the United States from other competitors. Regulators have cultivated innovation and American growth at each step. Financial services is one of America’s largest exports and biggest industries–the result of continued hard work and design, rather than coasting on prior success.

In our recent proposal for Congressional Control contracts, the CFTC wanted to hear the public's opinion. The public undeniably spoke in favor. There is bi-partisan support, from industry, SMBs, ex-CFTC/SEC regulators (including 3 commissioners), non-profits and academics:

Years have gone into developing a safe marketplace through engagement with the CFTC. We're a safer alternative to unregulated trading activity.

This is about much more than just elections: The CFTC’s decision will send a strong signal about how broadly federal agencies interpret their authority. And how they seek to engage with responsible innovators.

Read our full statement out now.

We love to hear from our members - submit market requests here